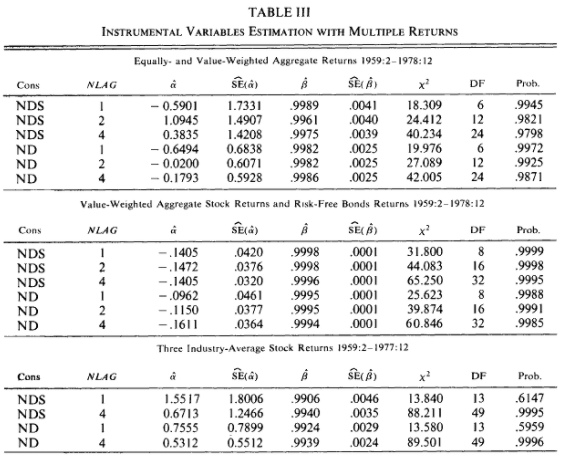

We aim to replicate a table below by using monthly data from 1960-1 to 2020-12.

Note: The panels of Table III that this assignment asks you to replicate appear in their errata published in 1984.

ENV["COLUMNS"]=100; ENV["LINES"]=1000

# Importing packages...

using Pkg; Pkg.activate("./..");

using Distributions, Statistics, Random, HypothesisTests,

LinearAlgebra, Distances, SharedArrays,

Optim, ForwardDiff, NLSolversBase,

Plots, Printf, LaTeXStrings, PlotThemes,

CSV, DataFrames, TimeSeries, Dates,

FredApi, FredData;

Activating project at `c:\Users\jaepi\OneDrive\Documents\GitHub\Prof_Miller_structural_econometrics`

Let $\beta$ be a $k\times1$ vector, $f_i(\beta)$ be a $l\times1$ moments, and $W$ be a $l\times l$ positive definite weighting matrix. Define the GMM criterion function $J(\beta)$ as $$ J(\beta) = N \left(\frac{1}{N}\sum_{i=1}^N f_i(\beta)\right)' W \left(\frac{1}{N}\sum_{i=1}^N f_i(\beta)\right). $$ The GMM estimator is $$ \hat{\beta}_{gmm} = \underset{\beta}{\arg\min}\; J(\beta). $$

Under general regularity conditions, $\sqrt{N}(\hat{\beta}_{gmm}-\beta_0) \xrightarrow[]{d} N(0,V_\beta)$ where $$ \begin{align*} V_\beta &= (Q'WQ)^{-1}(Q'W\Omega WQ)(Q'WQ)^{-1}\\ \Omega &= \mathbb{E}(f_i f_i') \\ Q &= \mathbb{E}\left[\frac{\partial}{\partial \beta'}f_i(\beta)\right]. \end{align*} $$ If $W$ is efficient, $V_\beta = (Q'\Omega^{-1} Q)^{-1}$.

Note that when you compute standard errors for $\hat{\beta}_{gmm}$, you must divide $V_\beta$ by $N$! $V_\beta$ is the variance for $\sqrt{N}(\hat{\beta}_{gmm}-\beta)$, not $\hat{\beta}_{gmm}$ .

In order to construct the efficient GMM estimator, we need to know what is the optimal $W$ in our model. In LIV, we know that $W=(Z'Z)^{-1}$. If the optimal weighting matrix $W=\Omega^{-1}$ is unknown, then we can first estimate $W$ with a standard GMM routine (say, by setting $W=I$), and then do the GMM routine again with $W=\hat{\Omega}^{-1}$.

In this case, we can simply code GMM as follows:

There is small difference between two-step GMM and One-step GMM with $W=(Z'Z)^{-1}$ because two-step GMM estimated $W$. As you increase $N$, this difference will disappear.

One could also iterate steps as many times as you wish until the updated $\hat{\beta}_{gmm}$ converges. This is called Iterated GMM. Note, however, the two-step GMM is already asymptotically efficient. You might want to use iterated GMM if you think the estimates are suffering from small sample.

function iterated_GMM(func, γ, y, X, Z; tol=0.001, max_iter=10)

#=

func: moment(s)

X: the matrix of variables that forms moments we wish to make 0

Z: the matrix orthogonal to moment

tol: if diff<tol, we claim the update converged

max_iter: if iter>max_iter, we stop and report what we have so far.

If max_iter = 2, then it is equivalent to two-step GMM.

=#

γ_GMM = Vector{Vector{Float64}}()

σ_GMM = Vector{Vector{Float64}}()

chi2_vec = Vector{Float64}()

pval_vec = Vector{Float64}()

diff_vec = Vector{Float64}()

N = size(func(γ, y, X, Z))[1];

l = size(func(γ, y, X, Z))[2];

k = length(γ);

df = l-k

func_vec(γ) = vec(sum(func(γ, y, X, Z),dims=1));

# First step

W_1 = I;

obj_GMM_1(γ) = N * (func_vec(γ)/N)' * W_1 * (func_vec(γ)/N);

opt_1 = optimize(obj_GMM_1, randn(k), BFGS(), autodiff = :forward);

γ_GMM_1 = vec(opt_1.minimizer)

Q_1 = ForwardDiff.jacobian(γ -> func_vec(γ) , γ_GMM_1)/N;

Ω_1 = func(γ_GMM_1, y, X, Z)'*func(γ_GMM_1, y, X, Z)/N;

V_GMM_1 = inv(Q_1'*W_1*Q_1)*(Q_1'*W_1*Ω_1*W_1*Q_1)*inv(Q_1'*W_1*Q_1)/N; # remember to divide by N!

σ_GMM_1 = sqrt.(diag(V_GMM_1))

chi2 = obj_GMM_1(γ_GMM_1)

pval = ccdf(Chisq(l-k),obj_GMM_1(γ_GMM_1)) # p-val

push!(γ_GMM, γ_GMM_1)

push!(σ_GMM, σ_GMM_1)

push!(chi2_vec, chi2)

push!(pval_vec, pval)

diff = 1e6

iter = 1

# Iterated GMM

while (diff > tol) & (iter < max_iter)

W_opt = inv(Ω_1)

obj_GMM_2(γ) = N * (func_vec(γ)/N)' * W_opt * (func_vec(γ)/N);

opt_2 = optimize(obj_GMM_2, randn(k), BFGS(), autodiff = :forward);

γ_GMM_2 = vec(opt_2.minimizer)

Q_2 = ForwardDiff.jacobian(γ -> func_vec(γ) , γ_GMM_2)/N;

Ω_2 = func(γ_GMM_2, y, X, Z)'*func(γ_GMM_2, y, X, Z)/N;

V_GMM_2 = inv(Q_2'*W_opt*Q_2)*(Q_2'*W_opt*Ω_2*W_opt*Q_2)*inv(Q_2'*W_opt*Q_2)/N; # remember to divide by N!

σ_GMM_2 = sqrt.(diag(V_GMM_2));

chi2 = obj_GMM_2(γ_GMM_2)

pval = ccdf(Chisq(l-k),obj_GMM_2(γ_GMM_2)) # p-val

# update

diff = sqrt(sum((γ_GMM_2-γ_GMM_1).^2))

Ω_1 = Ω_2

γ_GMM_1 = γ_GMM_2

iter += 1

# record

push!(diff_vec, diff)

push!(γ_GMM, γ_GMM_2)

push!(σ_GMM, σ_GMM_2)

push!(chi2_vec, chi2)

push!(pval_vec, pval)

end

return γ_GMM, σ_GMM, chi2_vec, df, pval_vec, diff_vec

end;

We consider the following model $$ 1=\mathbb{E}_{t}\left[r_{t+1, k} \beta \frac{u^{\prime}\left(c_{t+1}\right)}{u^{\prime}\left(c_{t}\right)}\right] \equiv \mathbb{E}_{t}\left[r_{t+1, k} MRS_{t+1}\right] $$ where:

Subtracting 1 from each side, we have: $$ 0=\mathbb{E}_{t}\left[r_{t+1, k} \beta \frac{u^{\prime}\left(c_{t+1}\right)}{u^{\prime}\left(c_{t}\right)}-1\right] $$ Under the assumption this model is true, we use data $\{(r_{t+1,k},c_{t},c_{t+1})\}_{t=1}^{T}$ and estimate the parameters of interest.

Let's parametrize the utility function as in Hansen and Singleton (1982). $$ u\left(c_{t}\right)=(1+\alpha)^{-1} c_{t}^{1+\alpha} $$ Notice this utility function exhibits constant relative risk aversion (CRRA) if $\alpha<0$. The population moment becomes a specific nonlinear function of data and parameters: $$ \mathbb{E}_t\left[r_{t+1,k}\beta\left(\frac{c_{t+1}}{c_{t}}\right)^{\alpha}-1\right] = 0 $$ where expectation is taken over the information available at $t$. In other words, any deviation from the equality $r_{t+1,k}\beta(\frac{c_{t+1}}{c_{t}})^\alpha-1=0$ is considered as error.

We wish to use information $\mathbf{x_t} \in I_t$ where $I_t$ the information set known by the agent and $\mathbf{x_t}$ a vector of information observed by econometrician at time $t$. If $\mathbf{x_t}$ is orthogonal to the moment, we can use $\mathbf{x_t}$ as an instrument: $$ \mathbb{E}\left[\mathbf{x_t}\varepsilon_t|I_t\right]:=\mathbb{E}\left[\mathbf{x_t}\cdot\left(r_{t+1,k}\beta\left(\frac{c_{t+1}}{c_{t}}\right)^{\alpha}-1\right)\right]=0 $$

We aim to construct the following data in estimation:

We use the following data:

#%% Fred Data: API available at https://github.com/markushhh/FredApi.jl

path = "C:/Users/jaepi/OneDrive/Documents/GitHub/Prof_Miller_structural_econometrics/2. Hansen and Singleton, 1982 (GMM)"

set_api_key("...."); # you should get your own API key!

# Monthly Data:

series_code = ["PCEND","DNDGRG3M086SBEA","PCES","DSERRG3M086SBEA","CNP16OV","GS1","CPIAUCSL"];

series_name = ["PCEND","PPCEND","PCES","PPCES","POP","RF","CPI"];

# Quarterly Data:

realND_code = "A796RX0Q048SBEA"; realND_name = "pce_real_ndg";

realS_code = "A797RX0Q048SBEA"; realS_name = "pce_real_svc";

init_date = "1959-12-01"; end_date = "2020-12-01";

Fred_df = DataFrame()

Fred_df[!,:timestamp] = DataFrame(get_symbols("PCEND",init_date,end_date))[1]

Fred_df[!,Symbol.(series_name[1])] = DataFrame(get_symbols("PCEND",init_date,end_date))[2]

for (i,j) in enumerate(series_code)

Fred_df[!,Symbol(series_name[i])] = DataFrame(get_symbols(j,init_date,end_date))[2]

end

wrds = CSV.read(string(path,"/WRDS.csv"),dateformat="mm/dd/yyyy")[13:end,:]; # 1960/01 to 2020/12

Fred_xt = TimeArray(Fred_df,timestamp=:timestamp);

wrds_xt = TimeArray(wrds,timestamp=:DATE);

local API key is set.

To interpret these results, lifetime utility is: $$ \sum_{t=1}^{\infty} \beta^{t} u\left(c_{t}\right)=(1+\alpha)^{-1} \sum_{t=1}^{\infty} \beta^{t} c_{t}^{1+\alpha} $$

Real Personal Consumption Expenditure on Nondurables $$ c_t = \frac{\text{Nondurables Consumption}_t * 1\text{e}9}{\text{Nondurables CPI}_t/100}*\frac{1}{\text{Population}_t * 1\text{e}3} $$ Real Personal Consumption Expenditure on Nondurables and Services $$ c_t^* = \left(\frac{\text{Nondurables Consumption}_t * 1\text{e}9}{\text{Nondurables CPI}_t/100}+\frac{\text{Services Consumption}_t * 1\text{e}9}{\text{Services CPI}_t/100}\right)*\frac{1}{\text{Population}_t * 1\text{e}3} $$ Real Value-weighted Return (VWRETD) $$ r_t = \text{Real Value-weighted Return}_t = \frac{1+\text{Value-weighted Return}_t}{\text{CPI}_{t}/\text{CPI}_{t-1}} $$ Real Equal-weighted Return (EWRETD) $$ r_t^* = \text{Real Equal-weighted Return}_t = \frac{1+\text{Equal-weighted Return}_t}{\text{CPI}_t/\text{CPI}_{t-1}} $$ Real S&P Return (SPRTRN) $$ r_t^{**} = \text{Real S\&P Return}_t = \frac{1+\text{S\&P Return}_t}{\text{CPI}_t/\text{CPI}_{t-1}} $$

# FROM FED

PCEND = Fred_xt[:PCEND].*1_000_000_000; # Billions of Dollars, Seasonally Adjusted Annual Rate

PPCEND = Fred_xt[:PPCEND]./100; # Index 2012=100, Seasonally Adjusted

PCES = Fred_xt[:PCES].*1_000_000_000; # Billions of Dollars, Seasonally Adjusted Annual Rate

PPCES = Fred_xt[:PPCES]./100; # Index 2012=100, Seasonally Adjusted

POP = Fred_xt[:POP].*1000; # Thousands of Persons

RF =(Fred_xt[:RF]./100)[2:end]; # Percent, Not Seasonally Adjusted from 1960/01 to 2020/12

CPI = Fred_xt[:CPI]./100; # CPI

# FROM WRDS

VWRETD = wrds[:vwretd]; # Value-Weighted Return (Incldues Distributions) (vwretd)

VWRETX = wrds[:vwretx]; # Value-Weighted Return (Excluding Dividends) (vwretx)

EWRETD = wrds[:ewretd]; # Equal-Weighted Return (Includes Distributions) (ewretd)

EWRETX = wrds[:ewretx]; # Equal-Weighted Return (Excluding Dividends) (ewretx)

SPRTRN = wrds[:sprtrn]; # Return on S&P Composite Index (sprtrn)

SPINDX = wrds[:spindx]; # Level on S&P Composite Index (spindx)

# Real Personal Consumption Expenditure

rPCENDpc = PCEND./(PPCEND.*POP);

rPCESpc = PCES./(PPCES.*POP);

rPCEpc = rPCENDpc .+ rPCESpc;

rPCENDpcRatio = rPCENDpc./lag(rPCENDpc,1,padding=false);

rPCEpcRatio = rPCEpc./lag(rPCEpc,1,padding=false);

TimeSeries.rename!(rPCENDpc, :rPCENDpc);

TimeSeries.rename!(rPCESpc, :rPCESpc);

TimeSeries.rename!(rPCEpc, :rPCEpc);

TimeSeries.rename!(rPCENDpcRatio, :rPCENDpcRatio);

TimeSeries.rename!(rPCEpcRatio, :rPCEpcRatio);

# Inflation and Risk-free Return

INF = CPI./lag(CPI,1,padding=false);

nRF = RF; # Nominal risk-free rate

TimeSeries.rename!(INF, :INF);

TimeSeries.rename!(nRF, :nRF);

# S&P market return

rVWRETD = (1 .+ VWRETD) ./ INF

rEWRETD = (1 .+ EWRETD) ./ INF

rSPRTRN = (1 .+ SPRTRN) ./ INF

TimeSeries.rename!(rVWRETD, :rVWRETD);

TimeSeries.rename!(rEWRETD, :rEWRETD);

TimeSeries.rename!(rSPRTRN, :rSPRTRN);

gr(fmt=png);

min_date = Dates.Date(1960,1,1)

max_date = Dates.Date(2020,12,1)

p1 = plot(rPCENDpc,label="",

title=L"C_{t}: \textrm{PCEND per capita (Deflated)}",

xlims = Dates.value.([min_date, max_date]),

xticks= min_date:Year(10):max_date)

p2 = plot(rPCENDpcRatio,label="",

title=L"C_{t+1}/C_{t}: \textrm{PCEND per capita Ratio}",

xlims = Dates.value.([min_date, max_date]),

xticks= min_date:Year(10):max_date)

p3 = plot(rPCEpc,label="",

title=L"C_{t}^{*}: \textrm{PCE per capita (Deflated)}",

xlims = Dates.value.([min_date, max_date]),

xticks= min_date:Year(10):max_date)

p4 = plot(rPCEpcRatio,label="",

title=L"C_{t+1}^{*}/C_{t}^{*}: \textrm{PCE per capita Ratio}",

xlims = Dates.value.([min_date, max_date]),

xticks= min_date:Year(10):max_date)

fig_c=plot(p1, p2, p3, p4, layout = @layout([p1 p3; p2 p4]), label=["" ""],size=(1200,800))

p1 = plot(rVWRETD,label="",

title=L"r_{t} \textrm{: Value-weighted Return}",

xlims = Dates.value.([min_date, max_date]),

xticks= min_date:Year(15):max_date)

p2 = plot(rEWRETD,label="",

title=L"r_{t}^{*} \textrm{: Equal-weighted Return}",

xlims = Dates.value.([min_date, max_date]),

xticks= min_date:Year(15):max_date)

p3 = plot(rSPRTRN,label="",

title=L"r_{t}^{**} \textrm{: S\&P Return}",

xlims = Dates.value.([min_date, max_date]),

xticks= min_date:Year(15):max_date)

fig_r=plot(p1, p2, p3, layout = @layout([p1 p2 p3]), label=["" ""],size=(1200,360))

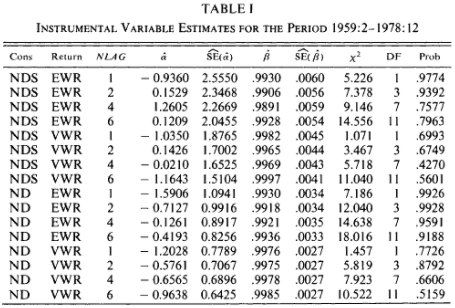

Before we get into Table III, let's see how we would replicate Table I:

Let's consider the first line. We are using NDS, EWR, in the moment function and one their lagged terms as instruments. $$ \mathbb{E}\left[\begin{pmatrix} 1\\ \frac{c_t^{*}}{c_{t-1}^{*}}\\ r_{t}^{*} \end{pmatrix} \cdot \left(r_{t+1}^{*}\beta\left(\frac{c_{t+1}^{*}}{c_t^{*}}\right)^{\alpha}-1\right)\right] = 0 \\ $$

# TABLE 1: EXAMPLE

# CONSUMPTION: NDS

# RETURN: EWR

# NLAG: 1

C⃰ = values(rPCEpcRatio)[2:end];

r⃰ = values(rEWRETD)[2:end];

X = [C⃰ r⃰]; # N×2 matrix

C⃰_L1 = values(lag(rPCEpcRatio,1,padding=false))[1:end];

r⃰_L1 = values(lag(rEWRETD,1,padding=false))[1:end];

Z = [ones(length(C⃰_L1)) C⃰_L1 r⃰_L1]; # N×l matrix

function f_HS_TABLE1_EXAMPLE(γ, y, X, Z)

#=

γ: parameters. γ[1]=α, γ[2]=β

X: the matrix of variables that forms moments we wish to make 0

Z: the matrix orthogonal to moment

We want to have a N×3 vector

=#

C⃰, r⃰ = X[:,1], X[:,2]

return (r⃰ .* γ[2] .* C⃰.^γ[1] .- y) .* Z # (N×1) ⊗ (N×3)

end;

γ_GMM, σ_GMM, chi2_vec, df, pval_vec, diff_vec = iterated_GMM(f_HS_TABLE1_EXAMPLE, rand(2), ones(length(C⃰)), X, Z; tol=1e-8, max_iter=100);

Note that the code returns p-values as pval_vec, not "Prob". In Hansen and Singleton (1982), they reported (1-p-value) in the Prob column.

print("Hansen-Singleton GMM Replication: Table I \n")

print("Instrument Variable Estimates for the Period 1960:1 to 2020:12 \n")

print("One-step GMM \n")

print("Consumption | Return | NLAG | α | se(α) | β | se(α) | χ² | DF | p-value ||\n")

@printf("NDS | EWR | 1 | %7.4f | (%7.5f) | %7.4f | (%7.5f) | %6.4f | %2i | %6.4f ||\n",

γ_GMM[1][1], σ_GMM[1][1],γ_GMM[1][2], σ_GMM[1][2], chi2_vec[1], df, pval_vec[1])

Hansen-Singleton GMM Replication: Table I Instrument Variable Estimates for the Period 1960:1 to 2020:12 One-step GMM Consumption | Return | NLAG | α | se(α) | β | se(α) | χ² | DF | p-value || NDS | EWR | 1 | -6.8895 | (4.25675) | 0.9991 | (0.00618) | 0.0000 | 1 | 0.9986 ||

print("Hansen-Singleton GMM Replication: Table I \n")

print("Instrument Variable Estimates for the Period 1960:1 to 2020:12 \n")

print("Two-step GMM \n")

print("Consumption | Return | NLAG | α | se(α) | β | se(α) | χ² | DF | p-value ||\n")

@printf("NDS | EWR | 1 | %7.4f | (%7.5f) | %7.4f | (%7.5f) | %6.4f | %2i | %6.4f ||\n",

γ_GMM[2][1], σ_GMM[2][1], γ_GMM[2][2], σ_GMM[2][2], chi2_vec[2], df, pval_vec[2])

Hansen-Singleton GMM Replication: Table I Instrument Variable Estimates for the Period 1960:1 to 2020:12 Two-step GMM Consumption | Return | NLAG | α | se(α) | β | se(α) | χ² | DF | p-value || NDS | EWR | 1 | -7.9837 | (4.40576) | 1.0013 | (0.00603) | 1.1553 | 1 | 0.2824 ||

print("Hansen-Singleton GMM Replication: Table I \n")

print("Instrument Variable Estimates for the Period 1960:1 to 2020:12 \n")

print("Iterated GMM until convergence with tolerance 1e-8 \n")

print("Consumption | Return | NLAG | α | se(α) | β | se(α) | χ² | DF | p-value | Iteration ||\n")

@printf("NDS | EWR | 1 | %7.4f | (%7.5f) | %7.4f | (%7.5f) | %6.4f | %2i | %6.4f | %5i ||\n",

γ_GMM[end][1], σ_GMM[end][1], γ_GMM[end][2], σ_GMM[end][2], chi2_vec[end], df, pval_vec[end], size(γ_GMM)[1])

Hansen-Singleton GMM Replication: Table I Instrument Variable Estimates for the Period 1960:1 to 2020:12 Iterated GMM until convergence with tolerance 1e-8 Consumption | Return | NLAG | α | se(α) | β | se(α) | χ² | DF | p-value | Iteration || NDS | EWR | 1 | -8.3454 | (4.50449) | 1.0017 | (0.00613) | 0.7906 | 1 | 0.3739 | 16 ||

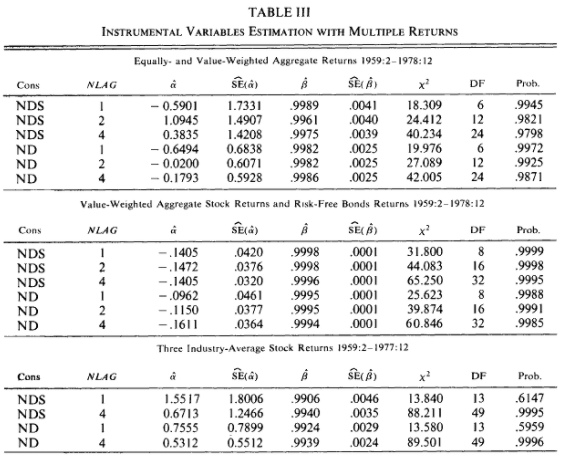

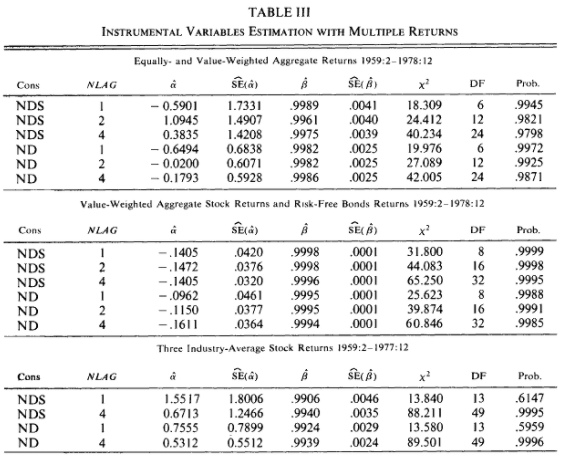

There is one more complication here: we now have two sets of orthogonality conditions. The first line estimates of Table III uses equally- and value-weighted returns, with one lag for each of the consumption ration and equally- and value-weighted returns. This is a set of 8 population moment conditions in 2 parameters ($\alpha,\beta$).

The degree of freedom (DF) is 2*(1+(NLAG of consumption ratio)+(NLAG of EWR)+(NLAG of VWR))-2

# TABLE 3: EXAMPLE

# CONSUMPTION: NDS

# RETURN: EWR & VWR

# NLAG: 1

C⃰ = values(rPCEpcRatio)[2:end];

r = values(rVWRETD)[2:end];

r⃰ = values(rEWRETD)[2:end];

X = [C⃰ r r⃰];

C⃰_L1 = values(lag(rPCEpcRatio,1,padding=false));

r_L1 = values(lag(rVWRETD,1,padding=false));

r⃰_L1 = values(lag(rEWRETD,1,padding=false));

Z = [ones(length(C⃰_L1)) C⃰_L1 r_L1 r⃰_L1];

function f_HS_TABLE3_EXAMPLE(γ, y, X, Z)

#=

γ: parameters. γ[1]=α, γ[2]=β

X: the matrix of variables that forms moments we wish to make 0

Z: the matrix orthogonal to moment

We want to have a N×8 vector

=#

C⃰, r, r⃰ = X[:,1], X[:,2], X[:,3];

m1 = (r⃰ .* γ[2] .* C⃰.^γ[1] - y) .* Z # (N×1) ⊗ (N×4)

m2 = (r .* γ[2] .* C⃰.^γ[1] - y) .* Z # (N×1) ⊗ (N×4)

return [m1 m2]

end;

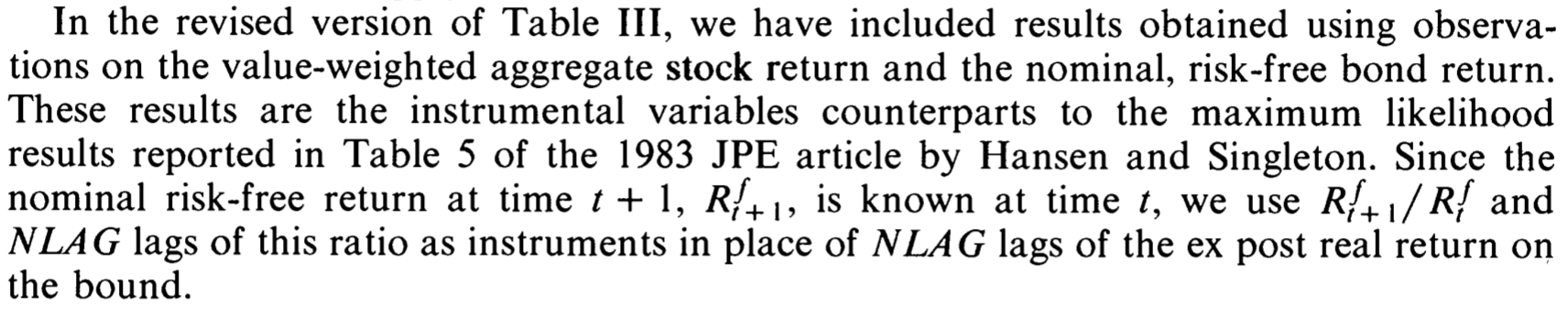

In Hansen and Singleton (1984), they describe how they used the nominal risk-free returns:

Their claim is that the degree of freedom is 2* [constant + (risk-free ratio + NLAG for risk-free ratio) + (NLAG for consumption ratio) + (NLAG for VWR)]-2

(Credit to Christine Dabbs) However, it seems like Hansen and Singleton double-counted the number of risk-free ratios. They have df = 8, 16, 32. These numbers are replicable if we counted degree of freedoms as:

2* [constant + 2*(NLAG for risk-free ratio) + (NLAG for consumption ratio) + (NLAG for VWR)]-2

Here, you are now estimating 4 parameters, $(\alpha_1,\beta_1,\alpha_2,\beta_2)$. You may want to find $(\alpha_1,\beta_1)$ only with data from 1960.1 to 1978.12 and $(\alpha_2,\beta_2)$ with data from 1979.1 and onward. You can change f_HS_TABLE3_EXAMPLE to do this exercise. You can only use data from 1960.1 to 1978.12 for m1 and use data from 1979.1 to 2020.12 for m2. You may also want to use $4\times1$ vector $\vec{\gamma}$. This is your 'unconstrained' GMM.

Now, you are asked to test $(\alpha_1,\beta_1)=(\alpha_2,\beta_2)$. The following theorem will be helpful:

Let $J_{un}$ be the unconstrained GMM criterion function with $l_1$ orthogonality conditions and $k_1$ parameters. Let $J_{con}$ be the constrained GMM criterion function with $l_2$ orthogonality conditions and $k_2$ parameters. Then, $$ J_{con} - J_{un} \overset{d}{\longrightarrow} \chi^2_{(l_2-k_2)-(l_1-k_1)}. $$

Additionally, you might be able to test models with more parameters in more time frames, say, before/after the financial crisis in 2008 and before/after COVID-19. To do so, you may need more instruments using more lagged variables.

I will leave questions 4 and 5 for you to explore. Now you have basic codes to run, I am sure you can easily modify code and get the estimates.

Let’s come back to data and think about big picture here. Hansen and Singleton (1982) assumes that we have a stationary environment. Test whether any of these series we considered in question 1 have a unit root. (You should read about unit root tests first.) Is there evidencethat these series are not stationary and ergodic?

I use Augmented Dickey-Fuller (ADF) Test. I will let you discuss whether you think time series data we used are stationary and ergodic.

(Not graded) TA's conjecture: Try ADF tests with i) a constant, ii) a trend, iii) a trend and trend squared. What do these tests tell you? If Hansen and Singleton (1982) requires stationarity, how would you incorporate the findings to your model?

varDF = DataFrame(varname=Vector{String}(),

varsymbol=Vector{Symbol}(),

vardata=Vector{TimeArray}())

varDF=vcat(varDF,DataFrame(varname="PCE per Capita (deflated)",varsymbol=:rPCEpc,vardata=rPCEpc))

varDF=vcat(varDF,DataFrame(varname="PCEND per Capita (deflated)",varsymbol=:rPCENDpc,vardata=rPCENDpc))

varDF=vcat(varDF,DataFrame(varname="PCE per Capita (deflated) ratio",varsymbol=:rPCEpcRatio,vardata=rPCEpcRatio))

varDF=vcat(varDF,DataFrame(varname="PCEND per Capita (deflated) ratio",varsymbol=:rPCENDpcRatio,vardata=rPCENDpcRatio))

varDF=vcat(varDF,DataFrame(varname="Real Equal-weighted Returns",varsymbol=:rEWRETD,vardata=rEWRETD))

varDF=vcat(varDF,DataFrame(varname="Real Value-Weighted Returns",varsymbol=:rVWRETD,vardata=rVWRETD))

varDF=vcat(varDF,DataFrame(varname="Real S&P Returns",varsymbol=:rSPRTRN,vardata=rSPRTRN))

for i in 1:4

name = varDF[:varname][i]

symbol = varDF[:varsymbol][i]

data = varDF[:vardata][i]

data = DataFrame(data)[!,symbol][2:end]

print("ADF Test: $name \n")

print(" | Coefficient | Statistic | p-value | \n")

for lags = [1,2,4,6]

stat = ADFTest(data, :none, lags).stat

coef = ADFTest(data, :none, lags).coef

pval = pvalue(ADFTest(data, :none, lags))

print("NLAGS:$lags |")

@printf(" %11.8f | %11.8f | %6.4f | \n", coef, stat, pval)

end

print("\n")

end

ADF Test: PCE per Capita (deflated)

| Coefficient | Statistic | p-value |

NLAGS:1 | 0.00085897 | 2.85174757 | 0.9996 |

NLAGS:2 | 0.00114181 | 3.93944023 | 1.0000 |

NLAGS:4 | 0.00131477 | 4.43821690 | 1.0000 |

NLAGS:6 | 0.00155524 | 5.11989688 | 1.0000 |

ADF Test: PCEND per Capita (deflated)

| Coefficient | Statistic | p-value |

NLAGS:1 | 0.00128219 | 3.41828302 | 1.0000 |

NLAGS:2 | 0.00164927 | 4.51403679 | 1.0000 |

NLAGS:4 | 0.00176250 | 4.68681891 | 1.0000 |

NLAGS:6 | 0.00189009 | 4.85354412 | 1.0000 |

ADF Test: PCE per Capita (deflated) ratio

| Coefficient | Statistic | p-value |

NLAGS:1 | -0.00004487 | -0.13793068 | 0.6365 |

NLAGS:2 | -0.00004233 | -0.14274545 | 0.6348 |

NLAGS:4 | -0.00001400 | -0.05039685 | 0.6673 |

NLAGS:6 | 0.00003243 | 0.12242773 | 0.7235 |

ADF Test: PCEND per Capita (deflated) ratio

| Coefficient | Statistic | p-value |

NLAGS:1 | -0.00008071 | -0.17065202 | 0.6247 |

NLAGS:2 | -0.00008845 | -0.21832532 | 0.6071 |

NLAGS:4 | -0.00002615 | -0.07215051 | 0.6598 |

NLAGS:6 | 0.00001318 | 0.03774306 | 0.6967 |

for i in 5:size(varDF)[1]

name = varDF[:varname][i]

symbol = varDF[:varsymbol][i]

data = varDF[:vardata][i]

data = DataFrame(data)[!,symbol][2:end]

print("ADF Test: $name \n")

print(" | Coefficient | Statistic | p-value | \n")

for lags = [1,2,4,6]

stat = ADFTest(data, :none, lags).stat

coef = ADFTest(data, :none, lags).coef

pval = pvalue(ADFTest(data, :none, lags))

print("NLAGS:$lags |")

@printf(" %11.8f | %11.8f | %6.4f | \n", coef, stat, pval)

end

print("\n")

end

ADF Test: Real Equal-weighted Returns

| Coefficient | Statistic | p-value |

NLAGS:1 | -0.00132420 | -0.55045316 | 0.4753 |

NLAGS:2 | -0.00079946 | -0.34919278 | 0.5569 |

NLAGS:4 | -0.00043876 | -0.20011743 | 0.6139 |

NLAGS:6 | -0.00026769 | -0.12388804 | 0.6416 |

ADF Test: Real Value-Weighted Returns

| Coefficient | Statistic | p-value |

NLAGS:1 | -0.00087740 | -0.43674454 | 0.5219 |

NLAGS:2 | -0.00047429 | -0.25249830 | 0.5942 |

NLAGS:4 | -0.00025356 | -0.14288880 | 0.6348 |

NLAGS:6 | -0.00013940 | -0.07966280 | 0.6572 |

ADF Test: Real S&P Returns

| Coefficient | Statistic | p-value |

NLAGS:1 | -0.00082647 | -0.42204541 | 0.5279 |

NLAGS:2 | -0.00043780 | -0.24036229 | 0.5988 |

NLAGS:4 | -0.00022709 | -0.13279936 | 0.6384 |

NLAGS:6 | -0.00012772 | -0.07558289 | 0.6586 |

References: